Which Is Best - Investing For Income Or Total Return: Part 2

High earnings growth produces the highest total returns.

Fast-growing companies offer little or no dividends.

It’s important to know where returns come from.

This article reveals the sources of returns and the associated risks.

Introduction

There is a long running feud between investors who believe in investing for total return versus those who believe in investing for current income. Both camps are fervent advocates of their respective beliefs, and there seems to be no feasible middle ground or compromise. Unfortunately, I believe that the dogmatic positions of both groups create a roadblock to investing enlightenment. In truth, there are valid arguments supporting both sides of these hotly-debated subjects. On the other hand, there are also valid arguments supporting investing for income over total return, and vice versa.

But more importantly, with investments there are many other considerations besides returns. The amount of risk a person is willing or capable of taking is a major consideration. There's also the size of an investor's portfolio relative to their future or current needs. In conjunction with portfolio size, there is the issue of how much time an investor has before they will need to begin harvesting money from their portfolio. Speaking of time, there are also the considerations of how much time and effort the investor is willing or capable of putting into managing their portfolios. These represent just a few of the other important considerations.

At the end of the day, how a portfolio is managed is ultimately dependent upon the goals, objectives and risk tolerances of each unique individual investor. With investing, there is no one size fits all, and there are numerous options to choose from. The key is to pick the strategies and investment vehicles that are best aligned with your own unique situation and needs. The portfolio that's right for you may not be the portfolio that's right for me. Consequently, we are all free to build, design and manage our own portfolios consistent with our individual circumstances.

Therefore, I see no reason for arguing for or against one strategy over another. On the other hand, regardless of whether we are investing for total return or income, I would argue that it's imperative that we understand the ins and outs of each respective strategy. Because in order to make the most appropriate decisions, it is imperative that we are fully cognizant of the advantages, disadvantages, benefits and pitfalls of each strategy. This article is offered to cover a few of the major differences between investing for income versus investing for total return.

Act Accordingly Through Knowing and Understanding Your Options

In part 1 of this 2-part series found here, I presented the primary sources or drivers of long-term returns.

I consider this critical information regarding choosing the strategy or strategies that are most appropriate for your own goals, objectives and needs. When you are aware of where and how returns are generated, as well as the risks associated with generating them, you are on your way to making rational decisions about how your portfolios can or should be run. Therefore, here in part 2, I will elaborate on why earnings growth (and/or cash flow growth) and valuation are the primary sources of total return.

Elaborating On Why Earnings and/or Cash Flow Growth Are a Primary Source of Total Returns

In the comment thread on part 1 of this series, my position that earnings growth (and/or cash flow), in conjunction with valuation as the primary sources of total return was challenged. Therefore, I want to take this opportunity to clarify what I was saying and validate the veracity of what I said.

The principal reason why earnings and/or cash flow growth is a primary source of return is simply because these metrics are value creators. A business creates value for its shareholders in direct proportion to its operating success in the long run. The faster a business grows the more value it creates as it generates a higher level of earnings and/or cash flow - and does so faster.

Consequently, I submit that earnings and/or cash flow growth is a primary source of the returns you can expect to earn through investing in a business over the long run. These long-term returns can manifest as pure capital appreciation that will highly correlate to the company's rate of change of earnings growth. Importantly, this will occur whether a company pays a dividend or not.

If a company pays a dividend, those dividends are paid out of earnings or cash flows, and as such, will contribute to total return via the income component. Total return is capital appreciation plus dividend income - if any. However, dividends are not the source simply because they are paid out of the source and therefore only contribute when the total return calculation is made.

Elaborating on Valuation as a Primary Source of Total Return

I contend that you make your money on the buy side. Consequently, when you invest in a company at a fair or sound valuation, your long-term returns will be highly correlated to the company's earnings and/or cash flow growth. To clarify this, I am suggesting that if a company grows earnings at 10% per annum, you can expect to generate capital appreciation of 10% per annum when purchased at sound value. If a company grows earnings at 5% per annum, your capital appreciation will be 5%, and so on.

Once again, this capital appreciation component will occur regardless of whether a dividend is paid or not. If the company does pay a dividend, your total return will be higher than the company's earnings and/or cash flow growth in direct proportion to the amount of dividends received over time.

On the other hand, if you overpay when you originally invest, overvaluation will reduce your total return to a level less than the company's earnings and/or cash flow growth rate. Of course, if you originally invest in a business at a low valuation, your long-term total return will exceed the company's growth rate. Additionally, it's important to understand that your total return will also be impacted by the valuation of your stock at the time performance is measured.

These valuation principles are why I also consider valuation a primary source of total return. In short, valuation will affect both the amount of capital appreciation and the amount of dividend income you will ultimately earn. Importantly, when valuation is in alignment at both the beginning of your investment as well as the ending period, your capital appreciation will be directly proportionate to the earnings growth rate your company achieved.

Since a picture is worth a 1000 words, I will more clearly illustrate these principles at work by presenting several divergent examples via F.A.S.T. Graphs™. However, before I do, I want to be crystal clear on a couple of important points.

First and foremost, what follows is a historical exercise presented to illustrate the undeniable correlation between earnings and/or cash flow growth and long-term returns. Secondly, I am not recommending any of the following examples as current purchases. However, many of them are attractive at current levels depending on your investment objectives. Nevertheless, these examples are offered to illustrate that earnings and/or cash flow growth in conjunction with valuation are the primary sources of long-term returns.

Therefore, my primary focus will be on illustrating the undeniable correlation between a company's business results and the returns that shareholders can expect or receive. In other words, I will be illustrating how a company's earnings growth rate will generate a very similar long-term rate of return when valuation is in alignment.

Consequently, I will be presenting each example from a beginning point in time when valuation was sound relative to earnings and/or cash flows. As a result, I will be presenting these examples over various time frames in order to illustrate the functional relationships existing between earnings and/or cash flow growth and valuation.

Additionally, in the commentary with each example, I will discuss important considerations regarding investing for income versus total return. As I suggested in the introduction, the proper strategy for each individual investor is the one that best meets their personal needs, goals and objectives. There is no one size fits all with investing.

As a result, investing for total return is no better or no worse than investing for income and vice versa. Instead, it's all about what is best for the individual investor relative to their unique circumstances, to include risk tolerances and other important considerations discussed above. Therefore, I will present several different types of individual common stocks and provide commentary on where and for whom I believe they might fit.

F.A.S.T. Graphs™ Interpretation

In order to receive the full benefit of the following presentation, it's imperative that the reader understands how to interpret the accompanying graphs. Therefore, this next series of graphs are presented one component at a time so that the reader understands precisely what they are seeing when viewing a complete graph. Furthermore, I have blocked out the name of the sample company in order to focus solely on the metrics that the graphs are displaying.

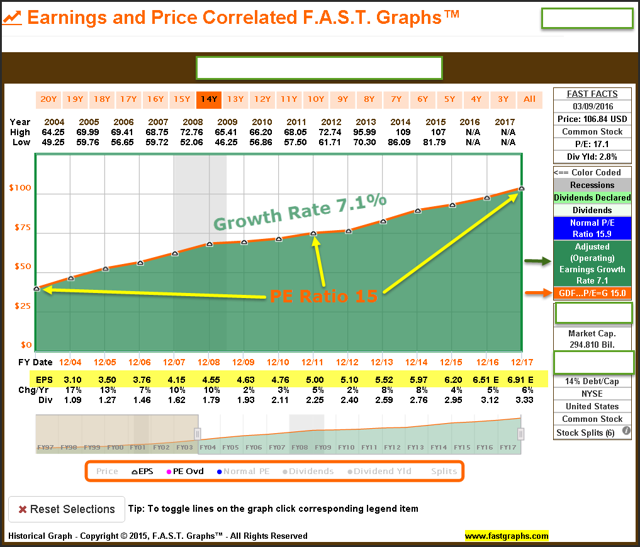

This initial graph plots earnings only since 2003. There are two aspects to the orange valuation reference line on the graph. First of all, the orange line is generated by multiplying each year's earnings by the P/E ratio found in the orange colored box in the FAST FACTS section to the right of the graph. Therefore, with this sample, the orange line on the graph represents a P/E ratio of 15. The P/E ratio of the orange lines will vary with different companies in the following actual examples.

The next aspect of the orange line is the slope of the line, which equals the company's earnings growth rate. The growth rate is found in the green colored box in the FAST FACTS section to the right of the graph. Therefore, the slope or growth rate of the orange line in the sample is 7.1%.

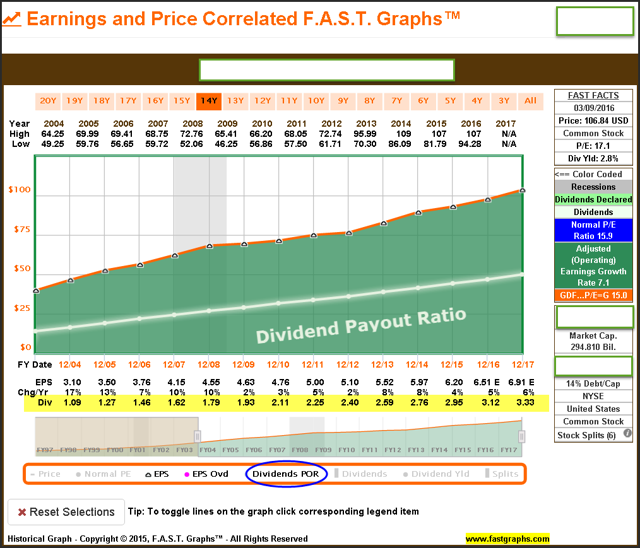

The dark green shaded area represents a mountain chart of the company's cumulative earnings over the time frame measured. With this graph, I have added the dividend payout ratio line (Dividends POR). The green shaded area below this white looking line represents the portion of earnings that the company has historically paid out in dividends (the dividend payout ratio).

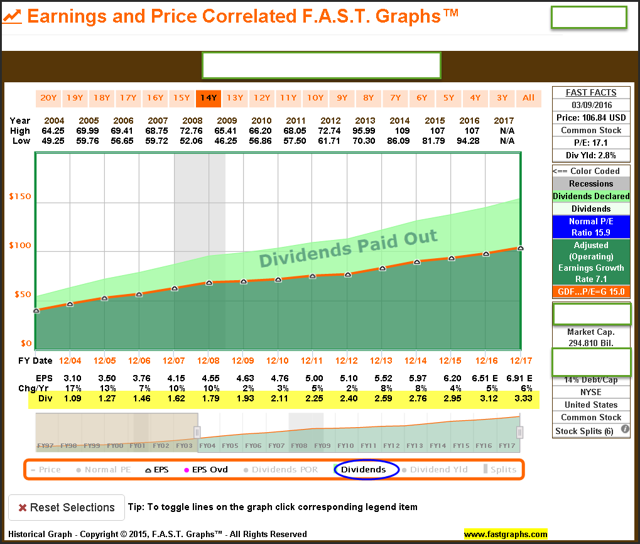

Once dividends are paid out, they are stacked on top of the orange earnings valuation reference line indicating the portion of earnings received by the shareholder as dividends paid. Therefore, dividends are expressed in two ways on each graph. The white line graphically presents the dividend payout ratio and the light green shaded area above the orange line illustrates the dividends after they have been received by the shareholders.

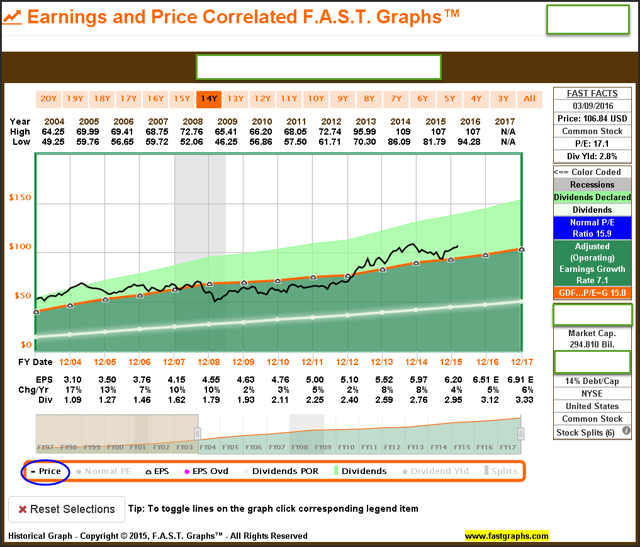

The final metric shown on each graph is the monthly closing stock price line (the black line). With each example to follow, the reader should note how the company's stock price follows or hovers around the orange earnings valuation reference line. The complete graph also illustrates how earnings (the orange line) generates capital appreciation, and how the light green shaded area (dividends), represent the additional income component of total return.

Pure Earnings Growth - No Dividends

With this first set of four examples, I will review non-dividend paying companies only. Consequently, the total return generated over the historical time frames measured will be pure capital appreciation exclusively. Most companies that do not pay a dividend fall into the growth category; however, there are exceptions to that statement. Nevertheless, the following four examples are presented in order of the earnings growth rates each achieved starting with lowest to highest.

As an aside, companies of this type are generally the kind that can produce the highest long-term total returns. Therefore, if total return is truly your objective, companies like the following might be your best choices. However, it should also be considered that it is difficult to achieve high rates of earnings growth. Therefore, a faster growing non-dividend paying stock like these should also be considered riskier than blue-chip dividend paying stocks.

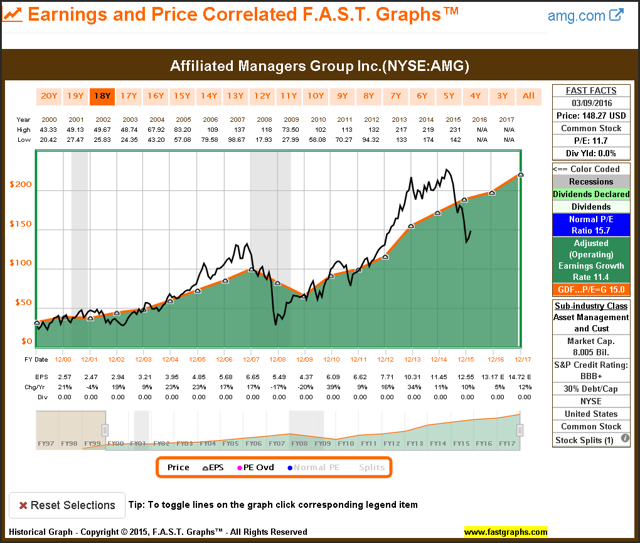

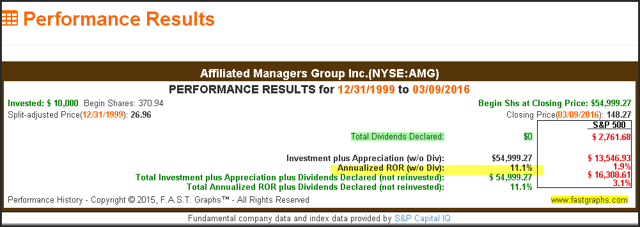

Affiliated Managers Group Inc. (NYSE:AMG)

Affiliated Managers Group is a global asset management company that has grown earnings per share at the compound annual rate of 11.4%. As you examine the earnings and price correlated graph below, note how stock price (the black line) has tracked earnings (the orange line) over this time frame. Also note that the company was moderately undervalued at the beginning of this time frame and has ended this period of time in a similar valuation. Consequently, if my thesis is correct, long-term shareholders would have received a total annual rate of return in the 11% range.

Additionally, note the effect that disconnects from fair valuation (the orange line) have on shorter-term returns. In other words, note how performance was poor following periods of overvaluation and how it was greater following periods of undervaluation.

The associated performance report with this first example supports my thesis that capital appreciation is functionally related to the company's earnings growth rate. Earnings grew at approximately 11%, and long-term shareholders likewise achieved capital appreciation of approximately 11% consistent with that earnings growth.

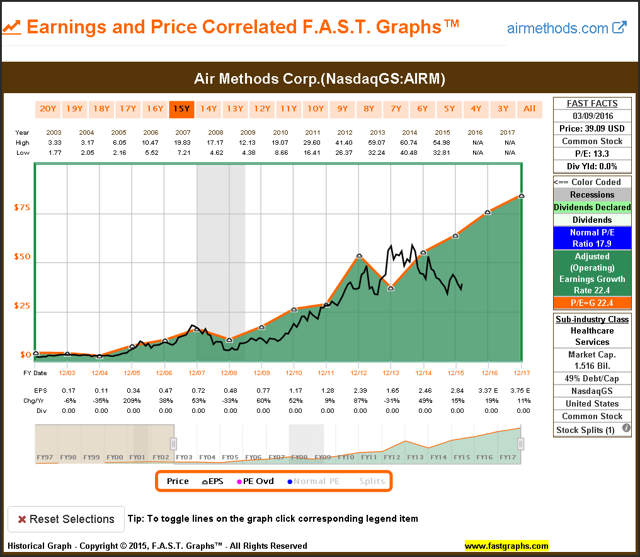

Air Methods Corp. (NASDAQ:AIRM)

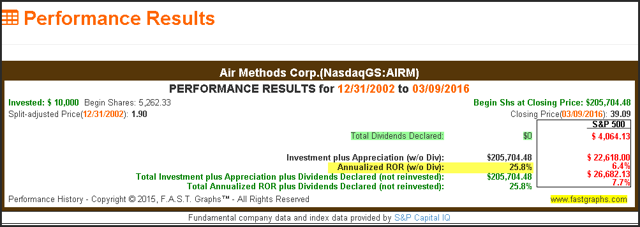

Faster growing Air Methods Corp. operates in healthcare services as an air medical transport company. With this example, we see a company that, again, pays no dividend, but has grown earnings at the annual compound rate of 22.4%. We also see a second example where stock price and earnings growth are highly correlated.

Note that Air Methods traded at a P/E ratio of 10.6 on December 31, 2002 or the beginning of the time frame measured, and ended with a P/E ratio of 13.3 on March 9, 2016. Consequently, we should logically expect that due to this modest P/E ratio expansion, that long-term shareholders would have achieved a long-term total rate of return modestly in excess of the company's earnings growth rate of 22.4%.

The associated performance report with the above graph validates the notion that capital appreciation is functionally related to its earnings growth rate achievement and valuation. The modest P/E ratio expansion referenced above generated an annualized total return of 25.8%, which is slightly above the company's earnings growth rate, but highly correlated. Earnings growth coupled with valuation was the source of this total return.

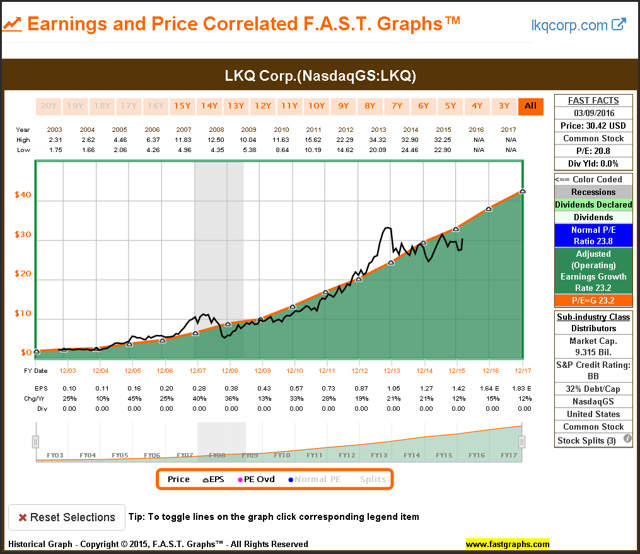

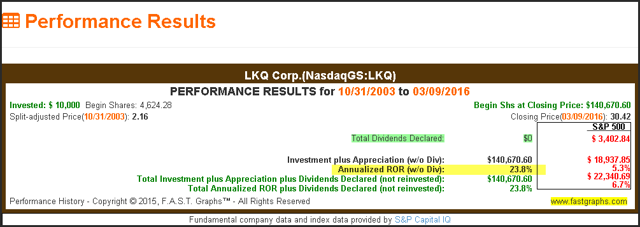

LKQ Corp. (NASDAQ:LKQ)

LKQ Corp. is best known as North America's largest provider of alternative collision auto parts. Since the company went public in October of 2003, it has produced consistent above-average earnings growth of 23.2%. Once again, we see a high and consistent correlation between stock price and earnings over time. We also see various time frames where stock price became temporarily disconnected from earnings. Furthermore, we might expect long-term shareholder returns to be highly correlated with the company's long-term earnings growth rate, and once again, based solely on capital appreciation and no dividends.

Long-term shareholders of LKQ earned a long-term total return (capital appreciation only) of 23.8% per annum, which virtually mirrored the company's earnings growth rate achievement. When you compare LKQ's returns with the S&P 500, you see a classic example of significantly above-average total return due to above-average earnings growth.

If total return is your objective, growth stocks like LKQ might be your best options. However, if current income is your objective, this kind of company might not suit your needs regardless of its excellent performance. With companies like LKQ, there are no dividends to provide a cushion during troubled markets.

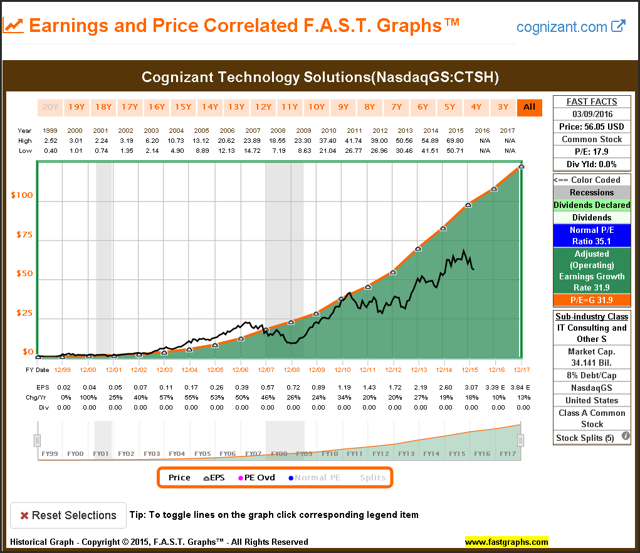

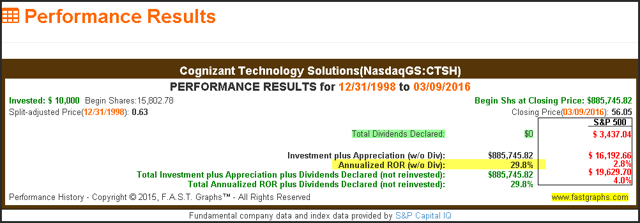

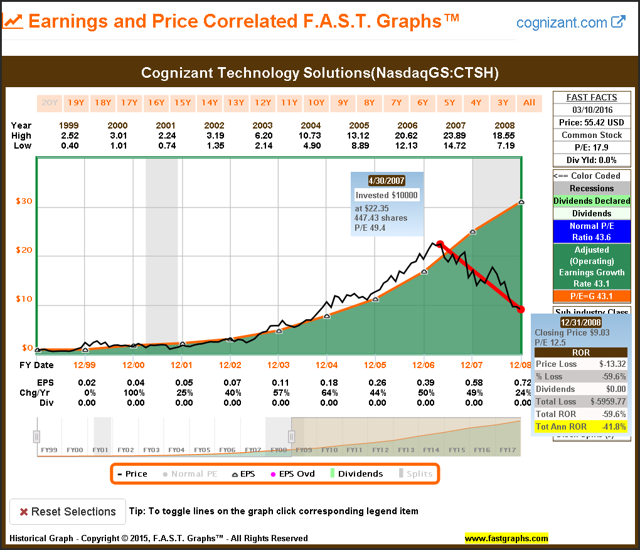

Cognizant Technology Solutions (NASDAQ:CTSH)

Since going public in December 1998, Cognizant has grown earnings at the remarkable rate of 31.9% per annum. Additionally, this IT consulting company's earnings growth has also been smooth and consistent. However, the reader should note that Cognizant looks undervalued relative to its earnings since 2011. Later, I will illustrate why this is so, and also how it supports the relationship between earnings growth, stock price and long-term returns.

Notwithstanding the apparent undervaluation referenced above, long-term Cognizant shareholders received a total return that was highly correlated to its long-term earnings growth rate achievement but slightly at a lower rate. This presents me the opportunity to illustrate an important risk associated with investing in high-growth stocks. Therefore, I offer two additional graphs on this growth stock to point out two important risks with investing for growth with no dividend.

This next earnings and price correlated graph on Cognizant ends on December 31, 2008 at the throes of the Great Recession. In spite of the fact that earnings growth remained quite strong in 2008, the company's stock price dropped approximately 60% from its previous high by the end of 2008. I have utilized the calculating functionality of F.A.S.T. Graphs™ to illustrate this devastating short-term performance.

With no dividends to cushion the blow, this had to be very traumatic for shareholders. Furthermore, for shareholders that were harvesting principle to generate income, this could only be considered catastrophic. Investing for total return can be quite fruitful, but risks can also be quite high - especially over the short run.

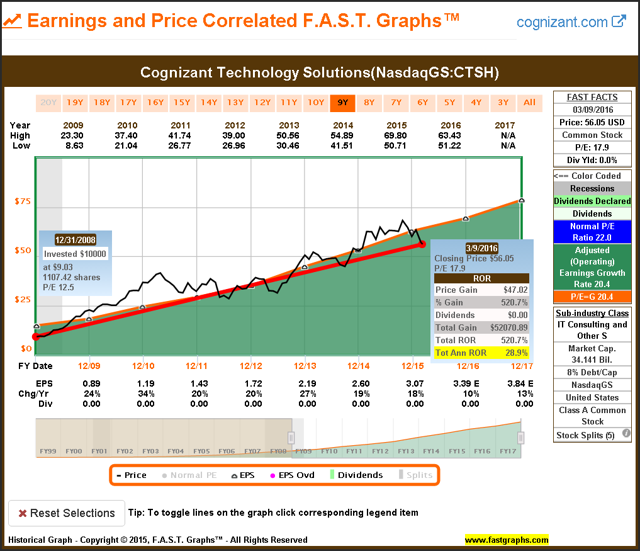

This final earnings and price correlated graph on Cognizant is offered to provide an additional lesson on the risks of investing in high growth stocks. It is extremely difficult for a company to grow earnings at high rates as Cognizant has achieved since inception. However, there are a couple of things to notice from the first two earnings and price correlated graphs above.

From inception to current, Cognizant's average earnings growth rate was 31.9% as shown in the initial graph. However, the second graph ending in 2008 shows that the company's earnings growth rate up to that time was much higher at 43.1% per annum. Clearly, Cognizant's earnings growth rate must have slowed down significantly since 2008. The final earnings and price correlated graph on Cognizant since December 31, 2008 illustrates that earnings growth since then has only averaged 20.4%. This is still a high number, but nowhere near as high as the previous timeframes shown.

There are several takeaways I hope the reader receives from this analysis. Price and earnings since 2008 have also been highly correlated. However, valuation has adjusted to the lower earnings growth rate of 20.4%. Therefore, although Cognizant looked undervalued currently over its inception to date time frame, the earnings and price relationship since 2008 shows an entirely different valuation picture. I believe this clearly illustrates that earnings growth rates are a primary source of long-term returns. On the other hand, I believe this also illustrates the reality that significantly high earnings growth rates are unlikely to persist indefinitely.

Dividends Low to High

With this next section, I will turn to reviewing dividend paying stocks. I will start out by showing a company with a very low yield, then higher growth and then progressively move up the higher-yielding stocks.

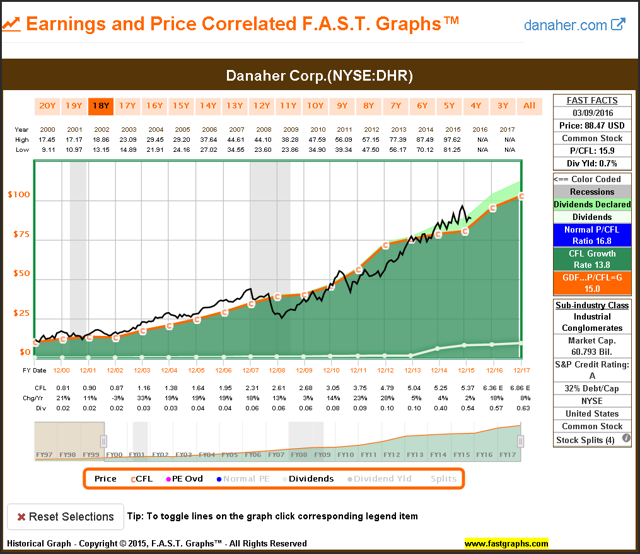

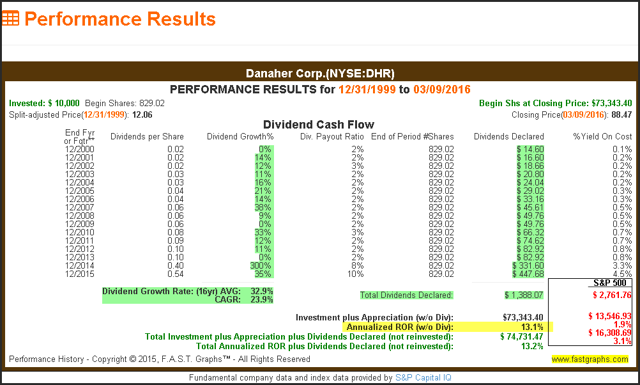

Danaher Corp. (NYSE:DHR)

Historically, Danaher has been a fast-growing company but with a low dividend yield and low dividend payout ratio. The reader should also note that I am utilizing cash flow growth in this example. Whenever I personally analyze any company, I always look at the relationship of price to earnings and then the relationship of price to cash flow. Danaher has consistently grown cash flow per share at the rate of 13.8% per annum, and price has followed growth long term.

Danaher has generated a long-term total return in almost perfect correlation to its cash flow growth. Dividends did contribute modestly to total return; however, capital appreciation was the dominant contributor.

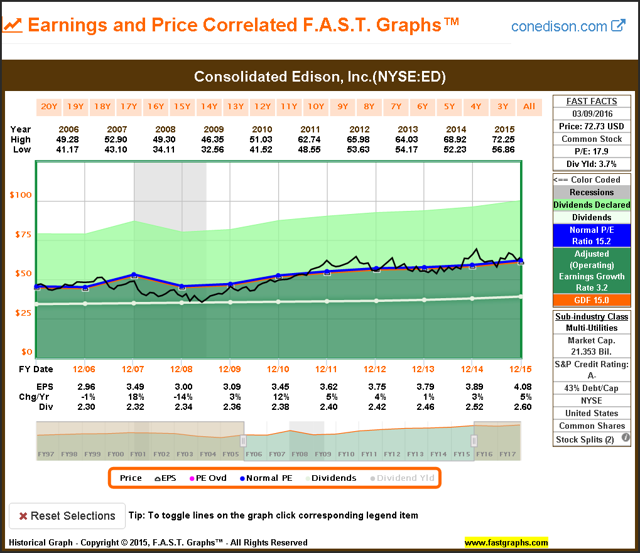

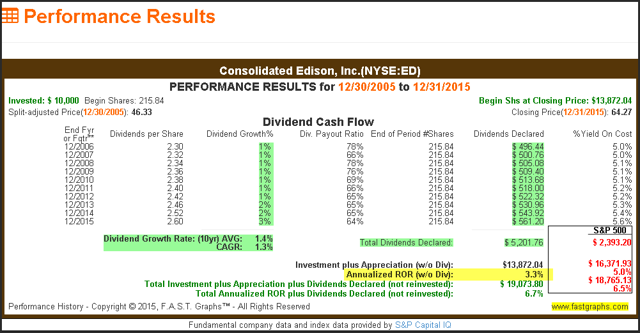

Consolidated Edison, Inc. (NYSE:ED)

I am presenting a different timeframe with high yielding utility Consolidated Edison, in order to clearly illustrate the correlation between capital appreciation and earnings growth when valuation is in alignment. The time frame expressed in this graph is 2006-2015. The earnings growth rate over this time frame was 3.2%.

In the performance report below, note that capital appreciation (annualized ROR w/o Div.) of 3.3% is virtually identical to the company's earnings growth rate of 3.2% shown above. However, also note that dividends contributed the majority of the total return achieved.

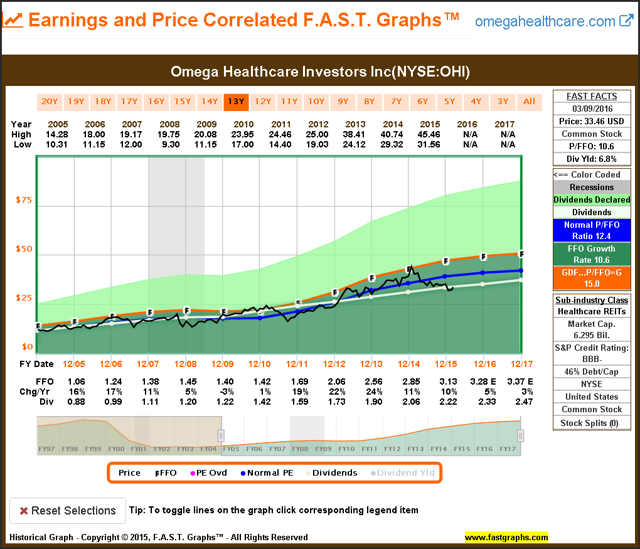

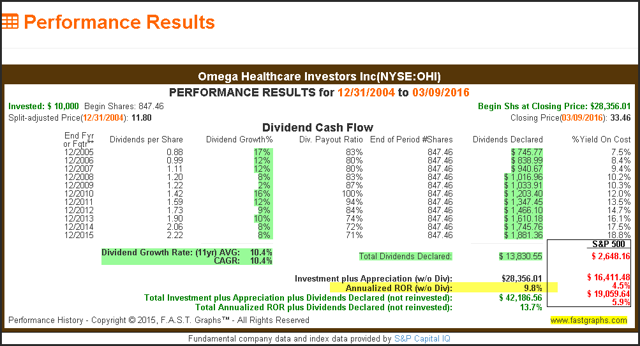

Omega Healthcare Investors Inc. (NYSE:OHI)

With the healthcare REIT Omega, we find a classic example of an investment that would appeal to both total return and income-oriented investors. In this example, funds from operations growth (FFO) was above average at 10.6% per annum. Moreover, this high-yielding REIT would also be attractive to the income-oriented investor.

When we examine Omega's performance since December 31, 2004, we see market beating capital appreciation of 9.8% in close alignment with FFO growth of 10.6%. Only Omega's current low valuation reduced capital appreciation below its FFO growth rate achievement. However, we also see a significant level of market beating total dividends declared. Since REITs are required by law to pay out approximately 90% of their distributable income, we have what might be considered the perfect compromise for both total return and income investors.

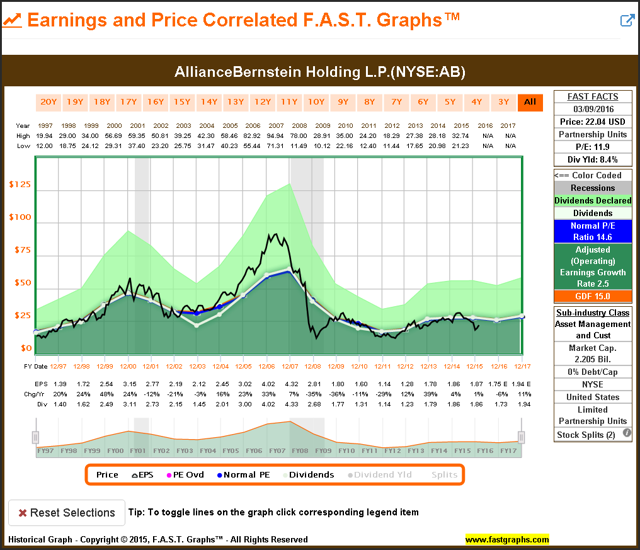

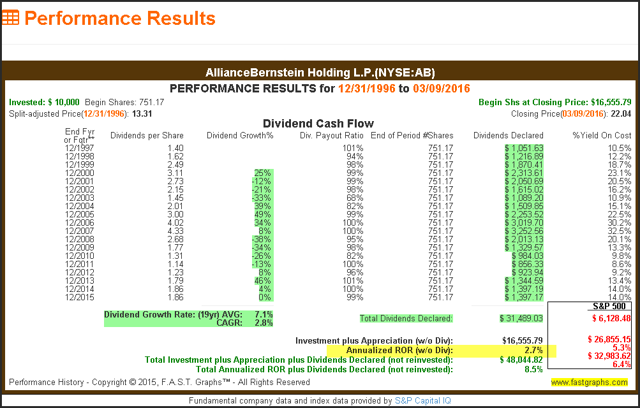

AllianceBernstein Holding L.P. (NYSE:AB)

My final example in the dividends low to high category is AllianceBernstein Holding L.P., a limited partnership that many readers may not be familiar with. I chose this unusual example because it so clearly illustrates how price tracks earnings over time, as well as how earnings growth over time was the source of capital appreciation.

Once again, we see capital appreciation almost perfectly mirroring earnings growth over time. However, this limited partnership pays out virtually all of its earnings. Consequently, it has historically produced an astounding amount of total dividends declared but with only modest capital appreciation. On the other hand, very cyclical earnings have also led to numerous dividend cuts over the years. Nevertheless, a close examination of this example illustrates earnings and valuation as the primary sources of total return. However, in this case, dividends have made a major contribution.

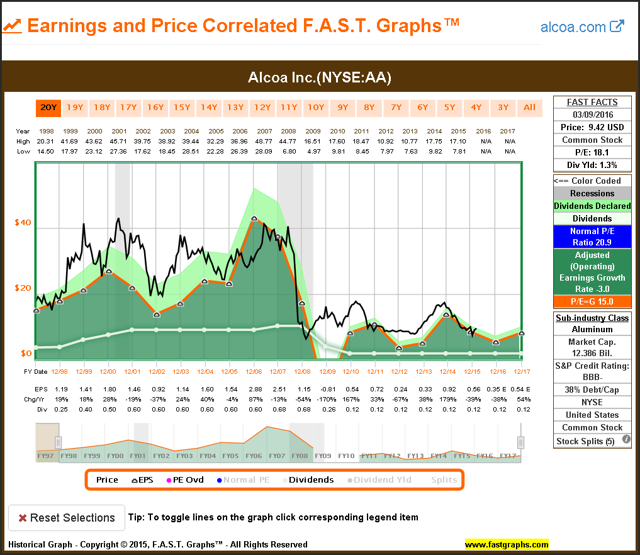

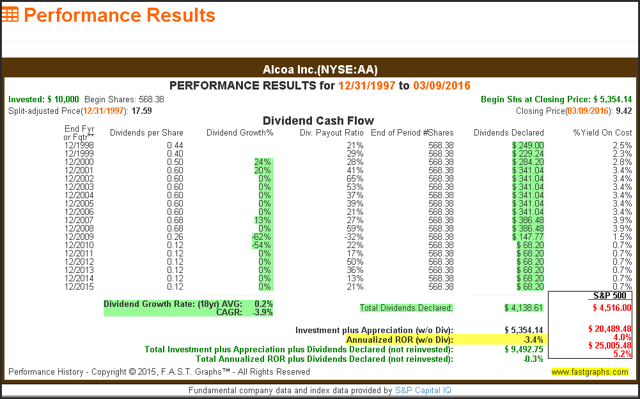

Earnings as the Source of Returns with Cyclical Companies

Deep cyclical stocks like Alcoa Inc. (NYSE:AA) also validate the thesis that earnings growth is a primary source of long-term total returns. However, in this case, it is the lack of earnings growth that also produced a long-term lack of capital appreciation. But most importantly, the long-term correlation between stock price and earnings results is undeniable.

Negative earnings growth of -3% produced negative capital appreciation of -3.4%, and inconsistent dividends helped, but only slightly. Nevertheless, this example illustrates the importance of earnings as the source of long-term total returns.

Summary and Conclusions

If you fall into the camp of total return advocates, then it only seems logical to me that growth stocks should be your primary investment choice. However, logic would also dictate that you must also be willing to assume the risks that go along with investing in growth stocks. With this article, I believe I have clearly illustrated the long-term relationship between earnings growth and capital appreciation. However, the hat trick when investing in growth stocks is identifying them before the growth occurs. This requires forecasting - and all future estimates contain uncertainty.

On the other hand, if you fall into the camp of investing for income, you must be willing to accept the reality that you may not get the highest total returns by doing so. This is not the case with every investment, as I illustrated with the Omega Healthcare example above. However, as a general statement, higher-yielding stocks will not be the ones that grow the fastest. Nevertheless, and again, as a general statement, they may well be the ones that produce the most current spendable income.

Therefore, I submit that perhaps the most rational approach is to embrace both strategies at various stages of your investing life. Prior to retirement, a strong commitment towards investing for growth offers the possibility of accumulating more money over time. Of course, there are risks to consider when doing that. Once in retirement, current income, especially if your portfolio is large enough to produce enough, might be the more appropriate choice. On the other hand, a blending of both strategies at appropriate levels might make sense as well. There is no one size fits all with investing.

Disclosure: Long LKQ,CTSH,OHI

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Disclosure: I am/we are long LKQ,CTSH,OHI.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

ไม่มีความคิดเห็น:

แสดงความคิดเห็น